How Automation Cut Loan Processing Time by 95% and Transformed Efficiency.

Customer

Leading SME financer in the Philippines, processing 100+ applications daily.

Challenge

Company A’s previous solution lacked advanced automation, relying on manual validation and data entry that slowed workflows and required significant resources.

mindox Solution

- AI-powered document processing with API integration.

- Real-time data extraction, validation, analysis and Human-In-The-Loop review tool.

Results

- 20x faster loan application processing.

- 95.83% reduction in manual document processing.

- 4x boost in employee productivity.

- 506 hours saved monthly, enhancing operational efficiency.

- Estimated $46,000 savings annually through automation.

Company A, a prominent financial services provider in the Philippines, processes over 100 loan applications daily. With a decade of experience delivering accessible funding solutions, they have established themselves as a leader in supporting SMEs. Always aiming to improve their business processes, Company A sought to enhance their operational efficiency using artificial intelligence (AI)-driven solutions like Intelligent Document Processing (IDP).

PROCESSING BANK STATEMENTS is a critical step in Company A’s loan approval workflow, providing the financial data needed to assess SME loan applications. As their client base grew, the increasing volume of applications demanded faster and more accurate reviews. However, their previous supplier lacked the necessary automation and relied heavily on manual validation, which significantly slowed down the process. This inefficiency limited them to processing only three bank statements per day before implementing mindox.

THE CHALLENGE for Company A was to address inefficiencies in their loan approval workflow while maintaining their reputation for speed and reliability. When the Mindox team assessed their existing solution, several limitations were identified:

- Processing submissions took two hours, delaying workflows.

- Lacked Human-In-The-Loop (HITL) to edit and resubmit documents.

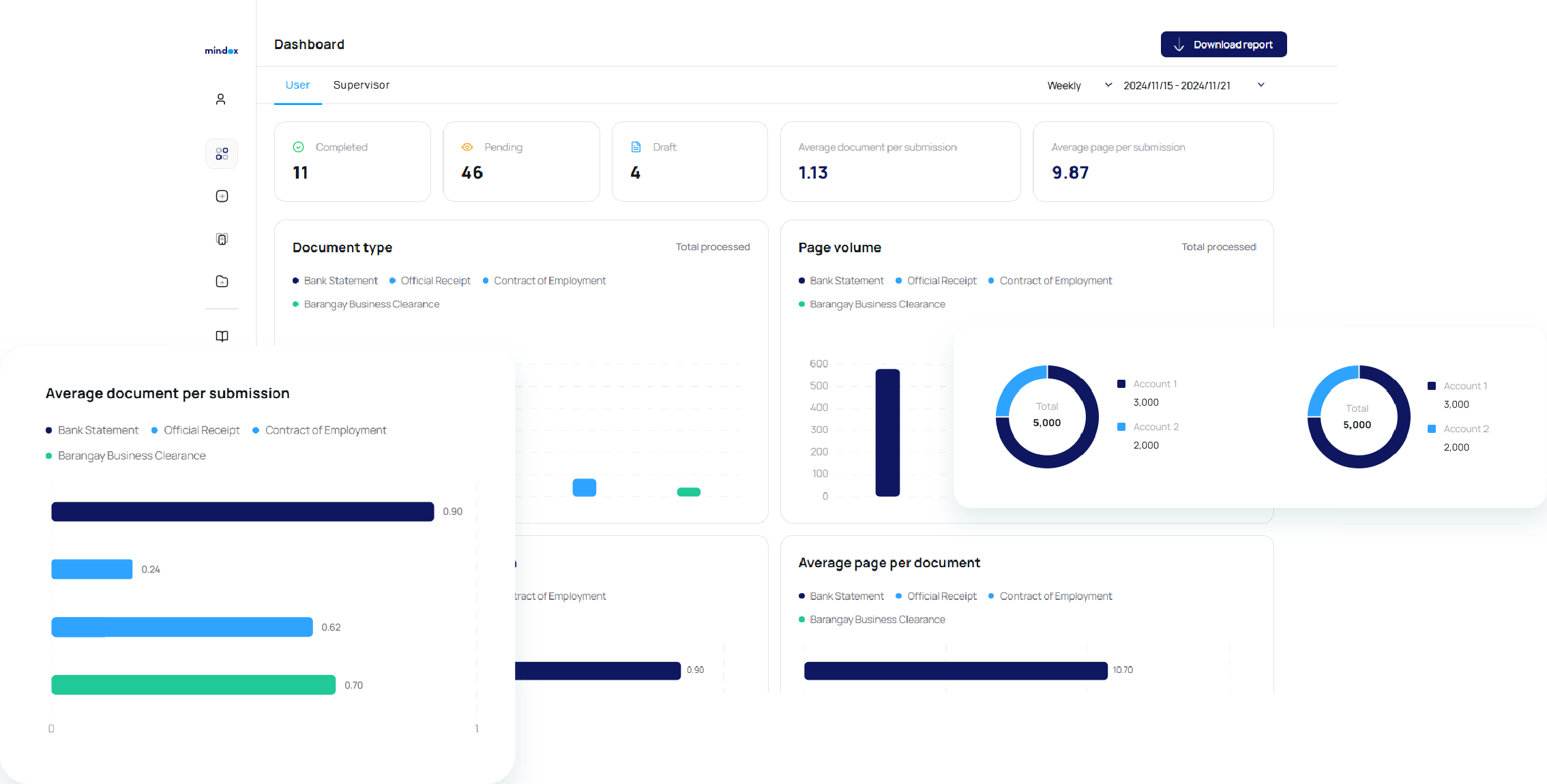

- No analytics or dashboards for performance tracking.

- Limited flexibility to handle increasing application volumes.

To address these gaps, Company A required a faster, more flexible solution capable of streamlining operations and improving customer satisfaction.

THE BEST SOLUTION the mindox team identified for Company A, after collaborating with their team, was to streamline their loan approval workflow and enhance document processing capabilities using advanced AI and automation. By implementing mindox, we enabled Company A to focus on serving their SME clients while we addressed the operational bottlenecks.

mindox reduced submission processing time from two hours to just 10 minutes, drastically improving loan approval speed. Using our Human-In-The-Loop (HITL) functionality, documents could be edited and resubmitted for validation, increasing acceptance rates without unnecessary rejections. Additionally, AI-powered analytics and dashboards provided real-time visibility into processing performance, helping Company A make more informed decisions.

THE IMPLEMENTATION ensured a seamless transition for Company A by introducing an intelligent document processing solution with the flexibility for additional customization tailored to their specific needs. Key aspects include:

- Seamless integration – Connected mindox to Company A’s existing document management systems (DMS) for real-time processing.

- Custom machine learning (ML) model training – Optimized model training for accurate and relevant data extraction.

- Analytics – Enabled real-time tracking and performance insights via dashboards, including Aggregated Account Balance, Average Daily Balance (ADB), and more.

- Training and support – Prepared the team with the guidance of a dedicated account manager to use HITL and analytics effectively while providing ongoing assistance from our customer success team.

This streamlined implementation allowed Company A to adopt a scalable, AI-driven system with minimal disruption, enabling enhanced operational efficiency.

THE RESULTS demonstrated the transformative impact of implementing mindox on Company A’s loan approval process. Key outcomes included:

- Processes automated

- Reduction in manual document processing: 95.83%

- Hours saved per month: 506 hours

- Operational efficiency

- Workflow speed improvement: 95.83%

- Processing capacity: 20x increase in document processing speed.

- Impact

- Savings: Estimated $46,000 per year.

- Employee Productivity: Boosted by 4x.

Company A went from processing three bank statements in an entire day to just 20 minutes, drastically reducing turnaround times and enhancing productivity.

These results empowered Company A to scale operations efficiently, improve accuracy, and deliver faster, more reliable loan approvals for their growing client base.

FOR MORE INFORMATION about how mindox can solve your document processing challenges, go to our CONTACT US page to fill out the form, and we will reach out to you promptly.